By Zain Asher, Lauren Gensler

Anxious for interest rates to rise in 2013? Take a chill pill.

The low rates of the past few years -- which have warmed the hearts of mortgage applicants but been cold comfort to savers -- are unlikely to budge soon. For that, thank (or blame) the Federal Reserve.

To spark growth, the Fed is aiming to keep the influential rate at which banks lend one another money between 0% and 0.25%, and it expects that number to be "exceptionally low" until at least mid-2015.

"This is unprecedented," says Baltimore financial planner Tim Maurer. "We've never had such low interest rates for such a long period of time."

Here are savings and credit strategies suited to the current climate:

MORTGAGES

Freeze your rate. Buying a home? Rates are at 40-year lows, so lock yours in with a fixed-rate mortgage; interest on a 30-year fixed was 3.57% in January.

"It's a sure thing," says Keith Gumbinger of mortgage data provider HSH.com.

Related: Sizing up bond investing risks

Lower your term. Refinancing? If you're certain to move within a few years, consider an adjustable-rate mortgage; initial rates on five-year ARMs were 2.68% in January.

Otherwise, use low rates to shorten your mortgage's term and cut interest costs. Should going from a 30-year mortgage to a 15-year be too big a payment hike, get a 20-year version. (About 15% of refinancers opt for a 20-year, says the Mortgage Bankers Association, up from 12% in 2011.)

You'd pay $905 a month on a 30-year $200,000 mortgage, $1,370 on a 15-year, but only $1,165 on a 20 (though 20-year loan rates are only slightly lower than 30-year rates). Run the math with the mortgage calculator at bankrate.com.

SAVINGS

Go long on CDs. Amid weak rates, park cash in a long-term CD with low withdrawal penalties, says Colorado Springs financial planner Allan Roth.

Put $50,000 in an Ally Bank (ally.com) five-year CD, lately yielding 1.58%; if rates rise, walk away in two years with $1,469 in interest (after a charge that cuts your rate to 1.45%). The same money in an average two-year CD yielding 0.45% would net only $451.

Beware rising-rate come-ons. Banks' new lure for savers: CDs with an option for a higher yield if rates rise. The catch is that you usually get a low initial rate.

"Shop around. Compare the rising rates with the fixed equivalent," says Larry Swedroe, research director at Buckingham Asset Management in St. Louis.

Related: 12 ways you're wasting money

The best of the bunch: a one-year rising-rate CD from CIT Bank (bankoncit.com), yielding 1.05% in January.

Go with the locals. For cash you need regular access to, you'll get the best rates at online banks. Union Federal Savings (unionfsb.com), for one, paid 1.05% in January.

If you want a nearby brick-and-mortar bank, though, think small. Michigan's Alden State Bank offers 0.30% on savings, vs. 0.01% from giant Bank of America.

"Community banks are somewhat less affected by the Fed and more by local demand," says Casey Bond, managing editor of GoBanking Rates.com. Go to findbankrates.com for the best rates in your area.

CREDIT CARDS

Rates are high, but you can still find good deals.

Transfer a balance. With card issuers in no hurry to lower rates -- the average is nearing 15% after more than two years in the 14% range -- a good way to land a rock-bottom rate is with a balance-transfer offer.

The best deal now: The Chase Slate Card, which has 15 months of 0% APR on purchases and transfers, plus no fee to transfer balances within the first 60 days.

Related: Reverse mortgage -- Is it too risky?

As with other credit card come-ons, issuers reserve their most enticing transfer offers for top-tier prospective customers. To join that club, says Ben Woolsey of CreditCards.com, you'll need a credit score above 750, up from 725 in 2008.

Get your reward. If you're not the type to carry a balance, go for a rewards card. Cash back is a hot deal, with initial rewards 20% more lucrative than last year, reports Cardhub.com.

The Capital One Cash Rewards Card offers a $100 reward for spending $500 in the first three months, 1% cash back on all purchases, plus an extra 0.5% bonus at each year's end.

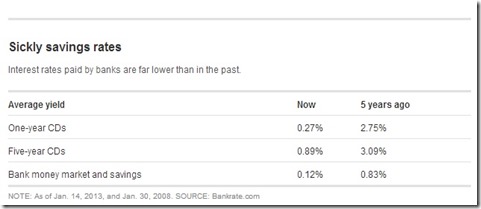

Sickly savings rates

Interest rates paid by banks are far lower than in the past.