BY KIM CLARK, SUSIE POPPICK, V.L. HARTMANN, JEFF INGLES, SUSAN JOHNSON, AUSTIN KILHAM, AND CHRISTINE LEE

Top experts and Money readers share their smartest tips on everything from selling a home quickly and winning a bidding war to cutting your electricity bills and prospering as a landlord.

1. Sell quickly. Win a bidding war.

home fast

Underprice it from the start. If you list your home for at least 10% less than it's worth, you'll often sell it for 10% more.

Buyers notice a house that's underpriced: They'll take it by storm and drive up the price with a bidding war.

People worry that setting the price low will deter bidders. That's not the case. If you don't get competitive bids, you didn't truly underprice the house to begin with.

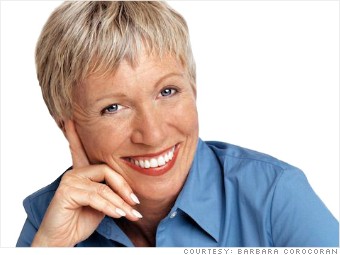

-- Barbara Corcoran, founder, real estate firm the Corcoran Group and panelist on ABC's "Shark Tank"

Win a bidding war

Go as high as the maximum price you'd ever be willing to pay -- if someone outbids you, you'll feel confident you gave it your best shot.

Sometimes it's not just about the money. Give the seller some breathing room too. Buyers often signal their interest by offering to close quickly, but that move might backfire in this market: If the sellers haven't found a new place yet, they may be unable to accept your offer.

Instead, propose a seller's residential lease. You close on the house quickly, then rent it back for 60 or 90 days. That gives the sellers a chance to look for a home in a non-panicked way -- and gets you the house you want.

-- Mary Beth Harrison, founder and realtor, Keller Williams Elite, Dallas

2. Tips for renters and landlords

Protect yourself as a renter

Your landlord or property management company can make or break your rental experience, so look online for negative reviews. Slow responses to maintenance calls and deceptive leasing practices, like advertisements for amenities that don't exist, are the most common complaints.

A first-time landlord is a slightly higher risk. Ask a lot of questions, including where he lives and who will respond to maintenance requests. Before you sign a lease, test everything -- appliances, windows, light switches. If anything needs to be fixed, make sure that's included in the rental agreement. And don't sign anything that holds you responsible for the building's exterior.

-- TJ Rubin, managing broker at Fulton Grace Realty, Chicago

Prosper as a landlord

Think like your worst-case tenant -- the one who'll never pay you a dime and never leave. These folks will take advantage of strict laws on when and why a tenant can be evicted. You need to know those laws just as well as they do.

Write your tenant lease to safeguard your rights, like setting community standards for noise, trash and other areas of possible neighborly nuisance. To protect yourself financially, put away a little money from the rent to cover potential legal costs.

-- Casey Edwards, long-time landlord and co-author of The Complete Idiot's Guide to Being a Smart Landlord

3.Cut needless expenses

Boost your energy efficiency

Start with changes that don't cost money, like closing and opening drapes. Switch off appliances you aren't using. Some TVs use more energy in the off mode than when they're on. Plug a TV into a power strip and turn it off.

-- Kateri Callahan, president of the Alliance to Save Energy

Take the drama out of a renovation

Don't walk blindly into a major renovation project. Know why you are remodeling, and define what you really need so you don't just pretty up a space that doesn't work for you.

And before you even contact a contractor or designer, take 25% of your renovation budget and sock it away. That way when your contractor finds water damage, you can fix the problem and move on without fighting about how much it's going to cost -- or what part of your plan you have to scrap to stay on budget.

-- Susan Solakian, consultant and author of The Homeowner's Guide to Managing a Renovation

4. Be prepared

Weather the next storm that hits

Because of changes insurers have made in recent years, you may have to shoulder a larger portion of your losses than in the past.

The more informed you are, the better your settlement will be. Don't wait for an insurer to estimate the replacement cost of your belongings: Make your own inventory, and tell the insurance company what you think it owes you.

Keep a journal of every conversation with your insurer. And keep binders with your receipts, estimates, and inventories. You have to be your own advocate.

-- Amy Bach, executive director of United Policyholders, an insurance consumer advocacy group

Learn to be handy

"Always Google a home project. You can save hundreds doing it yourself. I replaced the capacitor in my AC unit for $29 instead of paying the AC company $250."

-- From MONEY reader Adam Rubenstein, via Facebook

0 comments:

Post a Comment